# Entitlements of construction workers | ನಿರ್ಮಾಣ ಕಾರ್ಮಿಕರ ಹಕ್ಕುಗಳು

This chapter delves into the details of the 12 welfare schemes under the Karnataka Building and Other Construction Workers Welfare Board (Karnataka BoCW), introduced to support the well-being of construction workers in the state. These schemes operate within the framework of the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996 (BoCW Act).

ಈ ಅಧ್ಯಾಯವು ಕರ್ನಾಟಕ ಕಟ್ಟಡ ಮತ್ತು ಇತರೆ ನಿರ್ಮಾಣ ಕಾರ್ಮಿಕರ ಕಲ್ಯಾಣ ಮಂಡಳಿ (ಕರ್ನಾಟಕ BoCW) ಅಡಿಯಲ್ಲಿ ರಾಜ್ಯದಲ್ಲಿನ ಕಟ್ಟಡ ಕಾರ್ಮಿಕರ ಯೋಗಕ್ಷೇಮವನ್ನು ಬೆಂಬಲಿಸಲು ಪರಿಚಯಿಸಲಾದ 12 ಕಲ್ಯಾಣ ಯೋಜನೆಗಳ ವಿವರಗಳನ್ನು ಪರಿಶೀಲಿಸುತ್ತದೆ. ಈ ಯೋಜನೆಗಳು ಕಟ್ಟಡ ಮತ್ತು ಇತರ ನಿರ್ಮಾಣ ಕಾರ್ಮಿಕರ (ಉದ್ಯೋಗ ಮತ್ತು ಸೇವಾ ಷರತ್ತುಗಳ ನಿಯಂತ್ರಣ) ಕಾಯಿದೆ, 1996 (BoCW ಕಾಯಿದೆ) ಚೌಕಟ್ಟಿನೊಳಗೆ ಕಾರ್ಯನಿರ್ವಹಿಸುತ್ತವೆ.

# Summary of key issues

Workers in construction and related work face a number of challenges in accessing welfare entitlements and these are summarised on this page.

Field coordinators should note that BoCW schemes do not have any components that address social deprivations except scholarships for children. There are no separate provisions or additional benefits for SCs, STs, OBCs or minorities.

| ***ATTENTION:***

*Field coordinators should note that BoCW schemes do not have any components that address social deprivations except scholarships for children. There are no separate provisions or additional benefits for SCs, STs, OBCs or minorities.*

|

Exclusion owing to policy design

- Employment in construction sector is not enough

- Not everyone employed in a construction firm is covered. Certain job profiles such as gardeners and parking area employees are excluded.

- Some components such as marriage allowance are available based on domicile in state.

- The process for availing benefits is dependent on mobile phones

- From obtaining Aadhar card to Aadhar seeding and conveying the one-time passwords at each step, a mobile is required.

- Against the backdrop that the BoCW schemes do not have an underlying SC/ST component, schemes for the upliftment of SC/ST communities managed by the SC/ST Corporation are primarily for locals, leading to exclusion of SC/ST migrants.

Exclusion owing to lack of awareness

- Awareness of schemes that can be availed under BOCW is limited.

- Workers lack awareness of available schemes, in some cases even after having spent 20 years in this occupation.

Exclusion owing to lack of supporting documentation

- Unavailability of supporting documents or issues with supporting documents such as Aadhaar card discrepancies, name/age mismatches, absence of bank passbooks, and challenges in Aadhaar seeding for bank accounts.

Exclusion owing to technology or other process related reasons

- The Seva Sindhu portal experiences periodic slowdowns, and there are limitations on document size, often restricted to around 250kb per document.

- Scheme components such as pensions falling under the Revenue Department are more difficult to obtain whereas basic health, accident, and other entitlements under the jurisdiction of the Labor Department are much easier to obtain procedurally.

- Scholarship documentation: tight timelines and documentation challenges for scholarships requiring income and caste certificates. While income certificates are valid for 5 years, caste certificates remain valid for life. However, individuals often discover that their income certificates have expired when applying for scholarships, resulting in missed deadlines.

Exclusions owing to behavioural issues

- Trust concerns: many CSOs in the ecosystem charge fees to help with the application process. Another channel is cyber cafes that charge exorbitant amounts to get work done. There is general hesitancy in sharing documents since many times CSOs are unable to get the work done despite taking money and all documents. There are also security/ identity theft related concerns.

- Applicants find it difficult to remember login details.

Law/ Act under which these schemes are provided: BOCW (Building and Other Construction Workers) Act.

Implementation of the provisions under this act is through state-specific labor welfare boards.

Funding: welfare schemes under this act are financed by a 1% cess on all construction activities within the state.

| [Click here to access the Karnataka BoCW Welfare Board website ](https://karbwwb.karnataka.gov.in/en) |

# What are workers entitled to?

| Availing benefits under the provision of BoCW Act is a two-step process

BoCW ಕಾಯಿದೆಯ ನಿಬಂಧನೆಯ ಅಡಿಯಲ್ಲಿ ಪ್ರಯೋಜನಗಳನ್ನು ಪಡೆಯುವುದು ಎರಡು-ಹಂತದ ಪ್ರಕ್ರಿಯೆಯಾಗಿದೆ

Every worker must get a Labour Card first.

The labour card enables access to 14 different life-stage specific entitlements summarised in the table below.

|

| Benefits

| Amount (Rs.)

| Frequency

| Applies to

| Timeline for submission

|

| BOCW Card

| -

| -

| Worker

| After 90 days of work in B&C

|

| Pension

| 3,000

| Monthly

| Worker

| Within 6 months of turning 60

|

| Family pension

| 1,500

| Monthly

| Spouse

|

|

| Accident

| 1-5 lakhs

| One-time

| Nominee/ Worker

| Within 1 year of accident

|

| Medical

| 20,000

| -

| Worker + dependents

| Within 6 months of hospitalization, min 48 hours of hospitalization

|

| Thayi Magu Sahaya Hastha

| 500 per month for 3 years

| Monthly

| Women worker- first 2 children

| Within 6 months of delivery

|

| Maternity

| 50,000

| One-time

| Women worker- first 2 children

| Within 6 months of delivery

|

| Marriage

| 60,000

| One-time

| Self or children (max twice)

| Within 6 months of marriage

|

| Major ailment

| 200,000

| -

| Worker + dependents

| Within 6 months of discharge

|

| Education

| 5,000 to 75,000

| Annual

| 2 children

| Within 6 months of next academic year

|

| Disability pension

| 2,000

| Monthly

| Dependents

| Within 6 months of issue of disability card

|

| Funeral exp

| 4,000

| One-time

| Worker

| Within 1 year of death

|

| BMTC Bus Pass

| 2,100

| Monthly

| Worker

| -

|

| Toolkit

| 20,000

| One-time

| Skilled worker only

|

|

| House Assistance

| ** **

| ** **

| ** **

| ** **

|

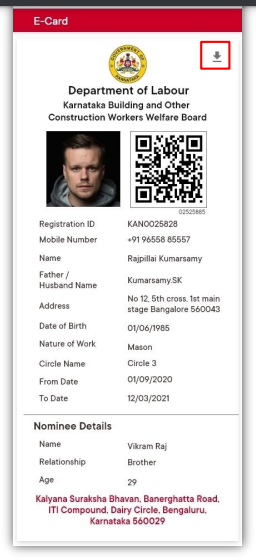

# Step 1: Getting the labour card | ಕಾರ್ಮಿಕ ಕಾರ್ಡ್ ಪಡೆಯುವುದು

### [](https://schemesandentitlements.org/public/uploads/images/gallery/2023-11/IQZscreenshot-135.png)

What is a BoCW labour card?

A BoCW labor card is an official identification card issued to construction workers who are eligible under the BoCW Act. This is the first basic document required to avail entitlements under the BoCW Act.

Every construction worker must renew their registration with the Board every 3 years. If not renewed within this period, a 1-year grace period is granted. After that, the registration becomes invalid.

[Click here for labour card registration webpage](https://labouronline.kar.nic.in/karBuildingcon/Building_Registration.aspx)

[Click here for labour card renewal webpage](https://labouronline.kar.nic.in/karBuildingcon/Building_AmendmentofReg.aspx)

What are the requirements to get a labour card?

- Employment certificate ((Form V(A)/V(B)/V(C)/V(D)))- proof of having engaged in building and other construction (B&OC) work for a minimum of 90 days in the previous year.

[Click here to download the 90-day work certificate template](https://karbwwb.karnataka.gov.in/42/schemes/en)

The employment certificate is validated by a labor inspector and employer/ registered labor union/ gram panchayat.

- Age- between 18 and 55 years

- Age proof- Voter ID or Aadhaar card

- Aadhaar card- linked to a mobile number (Self-Attested)

- Bank passbook copy

- Ration card (non-mandatory)

With a recent change in guidelines ration card is not mandatory now; till 6 months back this was a required document for labour card renewal.

- Nominee's bank passbook copy

- Nominee and children's correct name and age details

If nominee and children's details are not provided at this time or are incorrect, it will lead to difficulty in availing benefits under various schemes.

Common reasons why construction workers fail to receive the benefits under BoCW schemes

Exclusion owing to policy design

- Gardeners, parking area employees etc. roles not considered construction work (CW).

Another example: a person drives a vehicle supplying water on construction sites. When the labour inspector calls for verification, he says I am a driver. So, the application gets rejected.

Trades such as mason, plumber, electrician are considered part of CW.

- Petty labourers don’t get the seal/ sign of contractors as they are often involved in irregular work at different worksites under different contractors.

- Physical verification of hands to figure out if the person is working with sand and cement.

- Aadhar-mobile link mandatory, but workers change their mobile numbers frequently requiring repeated linking.

Hard labor affects accurate bio-metric fingerprints.

At the time of verification, worker may switch to another worksite hence not available on previous construction site where he applied from.

Exclusion owing to lack of awareness

- In extreme cases, workers who have been in this occupation for 20 years don't know about their entitlements.

Exclusion owing to lack of supporting documentation

- Many times workers leave their necessary documents at native place when they come for work, especially migrants from UP & Bihar

- Having a bank account with an Aadhar-linked mobile phone is a prerequisite, and many workers either do not have an account and/ or Aadhar card or the account is not linked with their Aadhar.

- Names, age and address don’t match in different documents

Petty laborers often face challenges in obtaining the seal or signature of contractors for work certificates since they work irregularly at various sites.

Exclusion owing to technology or other process related reasons

- BOCW website doesn’t stay up for more than 10 minutes at a stretch- it frequently takes them 5 hours to fill one application form.

- Technical issues such as maximum document size for uploading (250KB) and space also pose an important challenges while uploading docs.

- Workers don’t remember the login details which remain with CSOs, so trust building takes time.

- Lack of access to smart phones and in many cases a single phone number used by multiple members of the household. With a single phone number, if both father and son are laborers, only one gets the benefit albeit both have phone linked Aadhaar cards.

- In certain instances, workers' essential documents are kept in their hometowns, and their families there do not possess smartphones to send images of necessary documents, such as Aadhar cards, ration cards, PAN cards, and bank passbooks.

- Many labourers have been unaffiliated with any CSOs and often resort to costly cyber-cafés for application; rejections lead to money loss, discouraging scheme registration.

- Some CSOs take money from applicants to apply for cards/ schemes.

- Workers don’t remember the login details which remain with CSO.

Cyber centers often bribe officers to get work done.

Workers often change their phone numbers frequently, and their Aadhar numbers may not be linked to their current phone numbers.

For all Aadhaar linkage work, OTP comes to the applicant’s phone but they refuse to cooperate because they are at work or don’t see phones for a long time. So this application process needs to be repeated multiple times as OTP has time-bound validity.

Exclusion owing to behavioural issues

- Migrants often require a local address to benefit from various schemes, but they are reluctant to change their address due to concerns about missing out on opportunities in their home states or to preserve important documents and proofs.

Applicants, especially recent migrants, are hesitant to disclose all documents and information to CSOs (Civil Society Organizations).

Once the application gets rejected there is no refund. So, workers are apprehensive of wasting money and go via agencies.

Annual Renewal

- Muster roll or pay slip is required for renewal. It is not possible to obtain for muster roll for ‘gig’ workers within this occupation.

Trade unions can provide work certificate for 90 days but cannot provide muster rolls.

As per the recent experience of some partners, the labour department has stopped accepting renewals without muster roll because, according to them, many non-construction workers have enrolled. Awaiting new format of muster rolls from the department. Workers with big builders do not face this problem.

- Physical verification of hands to figure out person is working with sand and cement.

The labor card requires renewal either annually or every three years. Workers often fail to keep track and experience delays in renewal leading to a loss of access to benefits.

|

**Examples of CSOs going the extra mile to get work done**

- Certain CSOs enroll construction workers into unions, and these unions assume the comprehensive responsibility for addressing labor card issues, including renewal, corrections, and updates, such as Sampark and Grakoos.

- Mitr Sanketa takes an additional step by liaising with government departments to personally collect the paperwork required for laborers' card applications and access to various schemes.

- CFAR have set up a CSC (customer service centre) so can apply for schemes etc directly.

|

# Step 2.1: Medical assistance | ಕಾರ್ಮಿಕ ಆರೋಗ್ಯ ಭಾಗ್ಯ

[](https://schemesandentitlements.org/public/uploads/images/gallery/2023-10/NJH3WSIS90MBp7eu-download-2.jpg)

> Karmika Arogya Bhagya scheme provides registered construction workers and their families financial support to cover various medical expenses, including hospitalization and treatment costs.

What are the workers entitled to?

The financial assistance is applicable to registered construction workers and their family members who are hospitalized in a government hospital, a private hospital listed in Schedule I of the Karnataka Government Servant’s (Medical Attendance) Rules, 1963, or a hospital recognized under any state government insurance scheme.

Workers have to first pay and then seek reimbursement.

On paper, this assistance is available for a minimum continuous hospitalization period of 48 hours, and it amounts to Rs 300 per day of hospitalization, with a maximum cap of Rs 20,000, subject to actual expenses incurred. See a later section on this page for challenges in reimbursement especially with respect to minimum period of hospitalisation.

What are the eligibility criteria?

- The construction worker has to be registered and in possession of a valid labour card.

- The treatment can only be done in an approved hospital (government or private hospital, as per RSBY list).

- Claim has to be made within 6 months of hospitalisation.

What documents are required for application?

- Attested Proof of Identity/Smart card from the Board

- Employment Certificate

- Proof of Bank Account

- Hospital invoices detailing admission and discharge dates, inclusive of the provided treatment

- Any medical documents on hospitalization of beneficiary/dependent in government/private hospital included in schedule1 of the Karnataka government servants (medical attendance) Rules 1963

- Completed Form XXII-A from the hospital

- Applicants submit the application through KB&OWWB software

[Click here for a list of centers for enrollment](https://arogya.karnataka.gov.in/Forms/HospitalsList.aspx)

What is the procedure to apply?

- Applicant needs to submit the application through KB&OWWB software

[Click here to apply medical assistance](https://kbocwwb.karnataka.gov.in/login "Medical assistance application through KBOCWWB application")

At this step, applicants depend on CSOs for guidance and assistance on the paperwork/ online process.

- Application is first verified by a Senior/ Labour Inspector.

- In the final stage, the application is reviewed and approved by a Labour Officer.

Common reasons why construction workers fail to receive the benefits under Karmika Arogya Bhagya

Exclusion owing to policy design

- Reimbursement claim has to be made within 6 months of hospitalisation.

- Poor workers have to spend first from their own pocket and then claim reimbursement.

- This scheme applies to only registered construction workers and their families, not to all construction workers.

- Hospitalisation should have been only in approved hospitals. During emergencies, usual practice is to rush to a nearby hospital/ private nursing home.

Exclusion owing to lack of supporting documentation

- Obtaining attestation of the Identity/Smart card issued by the Board from a gazetted officer is challenging (time consuming).

Reimbursement made directly to the claimant's bank accounts via Direct Bank Transfer (DBT). Transaction fails if bank account is not linked to Aadhar.

Exclusion owing to reimbursement process related reasons

- Upon discharge from the hospital, construction workers often face difficulties in obtaining essential documents such as the pharmacy bill and final bill which are necessary to apply for assistance.

- Listed criteria indicate 48-hour hospitalisation, but applications are rejected if hospitalisation is for less than 7 days.

- The doctor providing the treatment must sign Form 22A for the construction worker, but obtaining the doctor's signature is often challenging. As an alternative, a backup signature is commonly used because of which claim applications are rejected.

Reimbursement is done only if treatment is in hospitals empaneled with the board.

Reimbursement rates range from 75% to 90%

No subsidized rates like CGHS for diagnosis, doctor fees, and medicines.

[Click here for list of approved hospitals](https://www.tesz.in/ApplicationForm/Ayushman-Bharat-Arogya-Karnataka-Hospital-List.pdf "Approved Hospitals")

What are the workers entitled to?

A registered woman construction worker is entitled to:

- Per child monthly Rs 500, for 3 years from the date of delivery to support early childhood education and provide nutrition assistance (lifetime total entitlement value of Rs 36,000 per woman).

- Applies to the first 2 children only.

Applications should be submitted within six months of delivery.

Please note: miscarriages are counted as live births.

What are the eligibility criteria?

- The woman worker has to be registered as a construction worker and in possession of a valid labor card.

Wife of a construction worker is not eligible for this benefit. In many cases, both husband and wife work as construction workers, but only the husband has a labour card, believing that one card is sufficient for the entire family.

What documents are required?

- Filled application form XVII-A

- An Affidavit stating that the claim for second Delivery

- Proof of bank account

- Photo of child

- Employment certificate

- Attested proof of identity/labor card issued by the Board.

- Discharge summary & birth certificate of child

- Ration card (is it reqd as address proof?)

- Child living Affidavit shall be submitted for second and third year

What is the application procedure?

Applicant needs to submit the application via the Seva Sindhu portal within 6 months of delivery.

- The application is first processed and verified by a Senior/Labour Inspector.

- In the final stage, the application is reviewed and approved by a Labor Officer.

[Click here to apply Thayi Mau Sahaya Hastha](https://sevasindhuservices.karnataka.gov.in/loginWindow.do "Click here to apply")

Every application has to be accompanied by the birth certificate of the child obtained from the Registrar of Birth and Deaths.

For continuity of benefits beyond the first year, application must be submitted for the second and third years as well. This also requires annual submission of an affidavit to prove that the child, for whom the benefit is claimed, is alive.

Common reasons why construction workers fail to receive the benefits under BoCW schemes

Exclusion owing to policy design

- This scheme applies only to registered woman construction workers, not spouses of construction workers.

- Women must prove that they have worked for 90 days in the year before delivery. Hard physical labour is challenging during pregnancy and the inability to prove makes women ineligible to claim the benefits.

- Proof of child's birth is necessary. Some migrants lack official birth documents when deliveries take place at home making them ineligible.

- 'Living child' affidavit is required for claiming benefits for the second and third years. Obtaining a lawyer's affidavit is challenging and costly.

- Miscarriages are counted as live births, only two live births allowed.

Minimum one-year waiting period for maternity benefit eligibility i.e. should be a registered construction worker for at least a year before claiming benefits.

Exclusion owing to lack of supporting documentation

- Most migrants choose to retain ration card from their villages so are unable to provide local address proof.

- Changing the address in Aadhaar, even within Bangalore, poses a challenge for migrant workers who relocate after marriage.

- A birth certificate for the child is necessary. In instances of home delivery, acquiring a discharge slip poses a challenge, creating obstacles in obtaining the birth certificate.

- An employment certificate is required, but who work irregularly at various sites, obtaining the seal or signature of contractors poses a challenge in acquiring the certificate.

- Applications can be submitted every year, for up to three years

- Workers may submit applications every year, extending up to three years. However, some workers may be unaware of this, leading to their exclusion from the scheme benefits.

Exclusion owing to eligibility conditions

- Eligibility for this scheme requires women to be registered as construction workers, and wives of construction workers are not eligible.

- Scheme is exclusively available to vulnerable households, mandating the possession of a ration card.

Exclusion owing to renewal related process

- The program spans three years and is renewable annually, but knowledge gaps can hinder the renewal process after the first year.

What are the major ailments?

**Major ailments** refer to serious health conditions such as heart surgeries, COVID-19, kidney transplants, eye surgeries, paralysis treatment, bone surgeries, uterus surgeries, asthma treatment, complications from miscarriage, gallbladder problems, kidney stones, brain hemorrhages, ulcers, cancer treatments, dialysis, surgeries related to kidneys, ears, nose, and throat, brain and nerve surgeries, blood vessel surgeries, throat and digestive system treatments, breast surgeries, hernia, appendix, bone fractures, or any other illness that the Board considers serious, including work-related diseases.

**Accident** means any physical injury that causes permanent disability (partial or full) or death as a result of an accident during work or while traveling between home and work. If the accident happens on the usual route between home and the workplace, and it results in death, it is also considered.

What are the workers entitled to?

Financial assistance is provided to registered construction workers and their dependents during hospitalization.

The assistance is applicable for a minimum continuous hospitalization period of 48 hours.

The financial aid amounts to Rs 300/- per day of hospitalization, with a maximum limit of Rs 200,000/-.

The application must be submitted within six months from the commencement date of hospitalization.

Hospitalization is limited to either a Government hospital or a private hospital listed in Schedule I of the Karnataka Government Servant’s Rules, 1963, or a hospital recognized under any insurance scheme of the State Government.

[Click here for list of approved Government and Private Hospitals ](https://karbwwb.karnataka.gov.in/uploads/media_to_upload1682670413.pdf "Click here for list of approved Government and Private Hospitals ")

On paper, this assistance is available for a minimum continuous hospitalization period of 48 hours, and it amounts to Rs 300 per day of hospitalization, with a maximum cap of Rs 20,000, subject to actual expenses incurred. See a later section on this page for challenges in reimbursement especially with respect to minimum period of hospitalisation.

What are the eligibility criteria?

- The construction worker has to be registered and in possession of a valid labour card.

- Every registered construction worker's dependent (in the case of the worker's death during treatment) eligible for medical expense assistance must submit an application in Form XXII to the Board.

- The treatment can only be done in an approved hospital (government or private hospital, as per RSBY list).

What type of documents required?

- Proof of Identity/Smart card issued by the Board

- Employment Certificate

- Proof of Bank Account

- Bills of hospital showing Admission and Discharge Dates and all treatment given

- Any medical documents on hospitalization of beneficiary/dependent in government/private Hospital included in the schedule1 of the Karnataka government servants (medical attendance)

- Rules 1963 or a hospital recognized under any insurance scheme of the state government.

- Filled form XXII-A

Application can be submitted within 6 months of the hospitalization commencement date.

Common reasons why construction workers fail to receive the benefits under BoCW schemes

Exclusion owing to on-ground implementation

- The scheme has a discrepancy in its hospitalization criteria. While it mentions a minimum of 48 hours, the actual application process requires a hospital stay of at least 7 days. Applications are rejected if the patient is discharged before completing this 7-day period.

- The scheme mandates treatment in a board-affiliated hospital, but instances of seeking treatment in non-affiliated hospitals have been reported, potentially affecting eligibility.

- Form 22 necessitates the signature of the attending doctor, but in many cases, a backup or substitute doctor signs it, leading to claim rejection.

Exclusion owing to Lack of awareness and trust among workers

- The lack of knowledge or awareness among laborers regarding the renewal process may lead to a failure to renew on time. This failure could subsequently result in the loss of benefits if an unforeseen event occurs.

What are the workers entitled for?

The Secretary or any other officer duly authorized by the Board shall approve an application from a registered female construction wo'rker for an amount of Rs. 30,000 for a female child and Rs. 20,000 for a male child.

Scheme is limited to the first two deliveries, upon submission of proof of childbirth.

The assistance will be provided in the form of a Fixed Deposit or Bond (Thayi Lakshmi Bond) in the mother's name, with a minimum maturity period of 3 years.

To gain benefits from the scheme, proof of child birth is necessary.

What are the eligibility criteria?

The Amount shall be sanctioned, only if the conditions are fulfilled namely.

1. Woman has to be registered as a construction worker

2. The registered woman construction worker can get this assistance only twice.

3. Second claim application shall be accompanied by an affidavit stating that the claim is for second delivery.

4. The certification of registration of birth obtained from the registrar of births and deaths or certificate of delivery in a government or private hospital in the state of Karnataka duly signed by the doctor concerned from the institution shall be produced along with the application.

The documentation states that registered female construction workers were initially expected to have no outstanding payments to the Board. However, it is necessary to verify whether this provision has since been revoked or abandoned.

The registered woman construction worker shall not be given this assistance if she already has two living children.

The scheme is exclusively sanctioned to registered female construction workers, and the wives of male construction workers are not eligible.

What type of documents required?

1. Attested Proof of Identity/labour card issued by the Board

2. Filled application form XVII

3. Proof of Bank Account

4. Photo of Child

5. Employment Certificate

6. Discharge Summary from hospital

7. Birth Certificate of Child

8. Affidavit for the second child

Application need to be submitted within 6 months of delivery

What is the procedure to apply?

1. Applicant needs to submit the application.

2. Application processing and Verification by Senior/ Labour Inspector.

3. Review and Approval by Labour Officer

Common reasons why construction workers fail to receive the benefits under Maternity scheme

Exclusion owing to policy design

1. If the husband is a construction worker, his pregnant wife, as the spouse of a construction worker, is not eligible for this facility.

2. To access this benefit, pregnant women are required to provide a work certificate demonstrating 90 days of employment before delivery. However, it may be challenging for a pregnant woman to engage in strenuous work for the full 90 days preceding delivery.

Miscarriages are considered as live births, and the eligibility criteria stipulate that only two live births are allowed under the scheme.

Exclusion owing to on-ground implementation

1. This scheme does not cover home deliveries, where women give birth at home. In such cases, since there is no discharge summary, they are unable to apply for the benefits.

Exclusion owing to lack of awareness

1. Lack of awareness amongst women workers to avail this scheme.

2. This program is offered for three consecutive years, after which it must be renewed annually. But after the first year, many people won't apply for the renewal owing to a lack of knowledge.

What is Marriage Assistance scheme?

Marriage Assistance Scheme designed to offer financial aid a sum of Rs. 60,000/- (Rupees Fifty Thousand Only) to registered construction workers, assisting them in managing the wedding expenses for two dependent children. The scheme provides this support through a grant, subject to specific conditions, including a prerequisite of at least one year between the worker's registration date and the date of their son's or daughter's marriage for which assistance is being sought. Can be availed for own marriage also.

What is the eligibility criteria for accessing benefits from the scheme?

- Minimum one-year lapse from applicant's registration date to the son or daughter's marriage date

- Application to be submitted within 6 months of marriage

- Assistance available for a registered construction worker's family only twice, with one claim per marriage

- Son or daughter must meet the legal age for marriage

- Certificate of marriage registration required

- Previous requirement of a Fixed Deposit or Bond eliminated; current scheme involves Direct Benefit Transfer (DBT) of INR 60,000.

- Application for claiming the amount should be in Form XXIII

Marriage assistance will only be provided if the son or daughter of the registered construction worker has reached the legal age for marriage.

Please check old provision- The registered construction worker shall have no dues payable to the Board.

What type of documents required for application?

1. Beneficiary/original Identity card, Issued by the board.

2. Employment Certificate

3. Bank Account details

4. Marriage Certificate by Registrar of the marriage

5. Marriage Invitation Card

6. Affidavit if marriage is outside Karnataka state.

7. Ration Card

8. Application submitted within 6 months of the marriage.

What is the procedure to apply?

1. Applicant needs to submit the application.

2. Application processing and Verification by Senior/ Labour Inspector.

3. Review and Approval by Labour Officer

4. Worker needs to be a domicile of Karnataka and marriage has to be done in Karnataka only.

5. Migrants from other states are not eligible at first place.

6. CW engaged in multi-occupation leads to outright rejection during inspections.

7. Applications restricted to registered labor department district.

8. Minimum 1 year old BOCW Card needed for scheme enrolment.

9. The family of a registered construction worker can avail this assistance only twice, however there shall be only one claim in respect of a given marriage irrespective of the number of registered construction workers in the family.

Common reasons why construction workers fail to receive the benefits under Marriage assistance

Exclusion owing to policy design

1. Worker needs to be a domicile of Karnataka and marriage has to be done in Karnataka only.

2. Migrants from other states are not eligible at first place.

3. CW engaged in multi-occupation leads to outright rejection during inspections.

4. Applications restricted to registered labor department district.

Exclusion owing to Workers/behavioral issues

1. Workers lack guidance for handling inspectors during inspections. Inspectors engage in conversation with neighbors, considering their input for worker eligibility assessment.

2. Claims pertaining to under age marriages are rejected.

Exclusion owing to eligibility conditions

1. Minimum 1 year old BOCW Card needed for scheme enrolment.

2. The family of a registered construction worker can avail this assistance only twice, however there shall be only one claim in respect of a given marriage irrespective of the number of registered construction workers in the family.

What are the workers entitled to?

Workers meeting eligibility criteria and contributing to the welfare fund qualify for a monthly pension of Rs. 3000 upon reaching the designated retirement age of sixty years.

A registered construction worker must remain a continuous beneficiary of the board for a duration of three years before reaching the age of 60.

Contribution is not mandatory post the commencement of COVID, but active engagement in the construction sector is still a prerequisite.

Application can be submitted within 6 months after attaining the age of sixty years

Eligible workers are required to submit a Living Certificate (Form XII-A) annually to qualify for the pension.

What are the eligibility criteria for accessing benefits from pension scheme?

1. **Age Requirement:** The beneficiary must have reached the age of sixty years.

2. **Duration of Beneficiary Status:** The beneficiary should have been registered as a beneficiary of the Board for at least six years before reaching the age of 60.

3. **Subscription Payment:** Eligibility is also determined by having paid the subscription fees until the age of sixty. In other words, those who have consistently contributed to the welfare fund until the specified age is eligible for the pension. (Note: This is not applicable currently.)

What type of documents required for application?

1. Filled application form XII

2. Attested photocopy of ID card

3. Original ID card submitted to the Board

4. Photocopy of beneficiary’s bank passbook

5. Ration Card.

6. Employer Certificate.

7. In case of Beneficiary death, nominee should provide death certificate to Board.

8. Before attaining age of 60 years registered construction worker shall be the beneficiary of the board continuously for the period of 3 years.

9. Application processing verification \[If required\] by the Senior/ Labour Inspector.

10. Review approval by the Secretary /Joint Secretary.

Application can be submitted within 6 months after attaining the age of sixty years.

Registering authority should submit the copy of the age proof of beneficiary which was submitted at the time of registration.

Common reasons why construction workers fail to receive the benefits under BoCW schemes

Exclusion owing to eligibility conditions

The scheme mandates that individuals have worked for a period of 3 years before reaching the age of 60 and maintained board membership for at least 6 years to access the benefits.

The scheme's requirement for individuals to work until the age of 60, despite the fact that many construction workers retire between the ages of 50 to 55, poses a significant challenge.

Exclusion owing to on ground implemenation

To qualify for the pension, it's required to submit an annual "living certificate." Yet, for numerous senior citizens, obtaining this certificate poses a challenge as they must personally visit the center where it's prepared, including providing biometric fingerprints. However, due to the physical strain of labor-intensive work, there are instances where these fingerprints may not match the records.

Examples of CSOs going the extra mile to get work done

Currently, the sole form of pension available is the old age pension; however, Fedina is actively working to establish a framework to expand pension coverage to retired construction workers.

Questions and scenarios for discussion

What happens when the retiree moves to another state?

What are the workers entitled to?

The Board or an authorized officer may approve a monthly disability pension of Rs. 2000, as per the Government of Karnataka Notification, for a beneficiary who is partially disabled due to any disease or accident at the worksite. Additionally, an ex-gratia payment of not more than Rs. 2,00,000 (Rupees two lakhs only) may be sanctioned, depending upon the percentage of disability.

What are the eligibility criteria?

A worker should be disabled

What documents are required for application?

1. Original ID card submitted to the Board

2. Photocopy of beneficiary's bank passbook

3. Provide a Living Certificate every year

4. Ration Card

5. Employer Certificate

6. Medical Report

7. ID card issued by the department for the empowerment of differently abled and Senior citizens

8. Photocopy of the disabled beneficiary

9. Application can be submitted within 6 months from the date of issue of disability ID card by the competent authority

10. In case of death of the Beneficiary Nominee should provide a death certificate to the Board

11. Application in Form XIV

12. subscription certificate by SLI/LI

**[Click here to apply for Disability pension ](https://kbocwwb.karnataka.gov.in/login)**

What is the Procedure for applying for a disability pension?

1. Applicant needs to submit the application.

2. Application processing and Verification by Senior/ Labour Inspector.

3. Review and Approval by the Assistant Labour Commissioner

Common reasons why construction workers fail to receive the benefits under disability pension scheme

Exclusion owing to eligibility condition

Labor must be registered as a construction worker to qualify for the scheme.

Exclusion owing to on-ground implementation

- Handling pensions of various types falls under the jurisdiction of the Revenue Department, posing increased complexities in the process

- Obtaining a disability certificate is challenging for individuals with disabilities who need to visit hospitals

- Upon receiving an acknowledgment, applicants are required to visit a specific designated hospital.

Only individuals with 50% or more disability are eligible for these pensions.

Application process involves applying online.

Women with disabilities are required to submit their applications to the Women and Child Development (WCD) department to obtain the necessary certificate, serving as an additional prerequisite.

According to the Mitr Sanketa's interaction with women in Bangalore, approval is granted to only 3-4 individuals out of 5000 applicants, and the specific reasons for rejection are undisclosed or unshared.

**Examples of CSOs going the extra mile to get work done**

- CFAR engaged in discussions with the health/disabilities department to propose the organization of camps.

- The initiative aimed to streamline processes by bringing document-signing authorities directly to communities, eliminating the need for disabled individuals to visit hospitals.

- Additionally, CFAR staff regularly participated in monthly UDID grievance meetings with officials from the CSC.

- Despite receiving approval, the printing of cards was a time-consuming step. Through CFAR's advocacy with the department, the necessity for a printed card has been eliminated, and a downloadable version is now deemed sufficient.

- CFAR did an outreach program with India Post Payments Bank (for awareness on opening low-cost bank accounts to avail of the various schemes Aadhaar-linked or other schemes).

# Step 2.8: Education Assistance | ಶಿಕ್ಷಣ ನೆರವು

[](https://schemesandentitlements.org/public/uploads/images/gallery/2023-11/education-assistance.jpg)

> The education assistance schemes aim to offer annual financial support to the children of registered workers, covering education from Class I to Diploma, Graduation, Post-Graduation, etc.

What financial support is available for the children of construction workers?

| **SI No.** | **Name of the education courses or standard or grade** | **Annual Educational assistance (INR)** |

| 1 | KG/Pre school/ Nursery (Age 3 to 5) | 5,000 |

| 2 | 1st to 4th standard | 5,000 |

| 3 | 5th to 8th standard | 8,000 |

| 4 | 9th to 10th standard | 12,000 |

| 5 | 1st PUC & 2nd PUC | 15,000 |

| 6 | ITI/Polytechnic/ Diploma | 20,000 |

| 7 | BSc Nursing (Paramedical)/ G.N.M / A. N. M | 40,000 |

| 8 | D.Ed. | 25,000 |

| 9 | B. Ed | 35,000 |

| 10 | Graduation | 25,000 |

| 11 | L.L.B/ L.L.M | 30,000 |

| 12 | Post Graduation (maximum 2 years) | 35,000 |

| 13 | BE/ B. Tech or equivalent Master's Degree | 60,000 |

| 14 | Medical (MBBS/ BAMS/ BDS/ BHMS/ or equivalent medical courses) | 60,000 |

| 15 | MD (Medical) | 75,000 |

| 16 | PhD/ M. Phil for any subject (maximum of 3 years for PHD and 1 year for M.Phil.) | 25,000 |

| 17 | IIT/ IIIT/ IIM/ NIT/ IIISER/ Courses accredited by AIIMS/ NLU and Government of India | Tuition fee |

What are the eligibility criteria?

Educational assistance is extended to the son or daughter of a registered construction worker.

**[Click here to apply for Education assistance scheme](https://klwbapps.karnataka.gov.in/student/login "Click here to apply for Education assistance scheme")**

**Guidelines for applying application**

**[Guidelines for applying application- Pre-Matric Scholarship](https://karbwwb.karnataka.gov.in/uploads/media_to_upload1659508237.pdf "Click here to read guidelines for applying application")**

**[Guidelines for applying application-Post-Matric Scholarship](https://karbwwb.karnataka.gov.in/uploads/media_to_upload1659508214.pdf "Click here to view")**

Common reasons why construction workers fail to receive the benefits under Education assistance

Exclusion owing to eligibility condition

- Labour has to be registered as a construction worker.

- The scheme is valid for a maximum of two children.

Exclusion owing to documentation

1. In Karnataka, all educational assistance schemes require the SATS ID, a state-specific identification that is often unavailable to migrants. The father's Aadhar is compulsory, but in cases where the father passed away before 2012, his Aadhar information is not accessible.

2. The schemes operate within a narrow time frame for application and demand various documents, posing challenges for migrants in obtaining the necessary paperwork from their places of origin.

3. Failure to accurately list the children's names on the labor card and providing incorrect details about the worker's children will lead to application denial.

Exclusion owing to policy design related

1. The scheme's benefits are seasonal in nature and can't be applied for continuously. In 2021, applications were accepted only in June, July, and August. In 2022, the window was open in February, March, and April.

2. Benefit applies only up to two children and remaining children are automatically out of the coverage.

3. Officials insist on SATS ID (student identification number) which is a KA specific document and migrants don’t have it in home state.

4. The delayed renewal of the father's labor card leads to missed deadlines due to the brief application window and a lack of awareness among laborers about the necessity to renew their cards.

Exclusion owing to tech & system related

1. Many universities have yet to update their college codes, and by the time they do, the deadline will likely have passed.

2. The portal frequently encounters server issues, causing delays in application submissions and resulting in application failures.

3. Moreover, there is a very limited time frame to apply for the scholarship, and the department often alters the application process, causing confusion among applicants.

4. The department modifies the process each year:

- In 2023: SS (Seva Sindhu)

- In 2022: Applications can only be submitted through SSP (State Scholarships Portal)

- In 2021: SS (Seva Sindhu)

What are accident related benefits under BoCW?

1. When a registered construction worker experiences an accident during their employment, the employer is obliged to provide compensation as per the Employee's Compensation Act, 1923.

2. The Secretary or an authorized representative may grant compensation as follows: 50% in a Fixed Deposit in a National Bank and 50% through an account payee cheque or Direct Benefit Transfer (DBT).

3. The compensation amounts are as follows:

1. INR 5 Lakh to the nominee in the event of death,

2. INR 2 Lakh for permanent total disablement, and

3. INR 1 Lakh for permanent partial disablement, proportionate to the degree of disablement as defined by the Employee's Compensation Act, 1923.

When are benefits from the accident scheme not provided?

Benefits will not be given under the following cases:

1. Natural Death

2. payment of compensation in Respect of Death or injury as a consequence of resulting from-

- Committing or attempting suicide, Intentional self-injury;

- whilst under the influence of intoxicating liquor or drugs;

- Committing any breach of law with the criminal intent;

- Pregnancy during childbirth, miscarriage, abortion or complication arising there from;

- curative treatments or interventions;

- venereal or sexually transmitted diseases;

- HIV or related illness;

- Any attempted crime on the body

What type of documents are required for application?

1. Photocopy of ID card attested by gazette officer

2. Photocopy of bank passbook Beneficiary or Nominee's in case of beneficiary’s death

3. Beneficiary/original Identity card, Issued by the board.

4. Respective application shall be made in Form XXI or XXI-B

5. Death Certificate (in case of death due to accident)

6. Postmortem report

7. Any Photo ID proof of Nominee

8. FIR copy

9. Medical report

10. Employer Certificate

11. Form XXI-A (This document has to be filled by the employer and uploaded)

12. Application shall be submitted within one year of accident

13. Subscription certificate by SLI/LI

Common reasons why construction workers fail to receive the benefits accident scheme

Exclusion owing to eligibility

- Labor must be registered as a construction worker to qualify for the scheme.

Exclusion owing to documentation related

- An attested photocopy of the ID card by a gazetted officer is required, posing challenges for migrant workers in obtaining the necessary attestation for the photocopy.

- In the unfortunate event of a worker's death due to an accident, both the death certificate and the post-mortem report are required.

- An FIR (First Information Report) copy is mandatory, even for minor accidents.

- Medical reports need to be provided.

- Form XXI-A, which must be completed by the employer and uploaded, is a scheme-related document.

What are the eligibility criteria to avail funeral expenses and the ex-gratia scheme?

1. Workers are required to register with the board.

2. Nominees eligible for the scheme must be specified during registration.

3. In the case of a legal heir, the Aadhaar number must be provided.

**[Click here to apply for assistance to meet funeral expenses and ex-gratia](https://kbocwwb.karnataka.gov.in/login "Click here to apply for assistance to meet funeral expenses and ex-gratia")**

What type of documents are required for the application?

1. Original ID card

2. Application in Form XVIII

3. Photocopy of bank passbook Beneficiary or Nominee in case of beneficiary’s death

4. Death Certificate attested by gazetted officer

5. Ration Card

6. Aadhaar Card

7. Employer Certificate

8. Any Photo ID proof of Nominee

9. Application shall be submitted within one year of death

10. subscription certificate by SLI/LI

Common reasons why construction workers fail to receive the assistance to meet funeral expenses and ex-gratia

Exclusion owing to eligibility condition

1. To avail themselves of the benefits, laborers must register as construction workers, but this requirement applies mainly to trades like masonry, plumbing, and electrical work, rather than to roles such as gardening and parking area maintenance, which are not categorized as part of the construction workforce.

Exclusion owing to on-ground implementation

1. A death certificate is a requirement, but if a worker passes away at home or in another state, obtaining the certificate can be delayed.

2. The deceased's name needs to be the same on both the death certificate and the labor card. Additionally, it is quite challenging to apply if the spelling changes.

3. If the nominee is a minor son, he might not possess an Aadhaar card, and even if he does, the funds will be granted upon reaching the age of 18

4. According to protocol, labor inspectors are mandated to physically visit the residence of the deceased to approve claims. Despite this, a significant portion of applications is often denied or rejected without an official visit.

5. An employment certificate is required when submitting a death claim, however, obtaining the certificate for the deceased is challenging.

Exclusion owing to policy design issue

1. If Aadhar is not seeded, they will not receive assistance because it would be sent to their account via DBT (Direct Bank Transfer).

2. Nominee is must; without one, funds cannot be disbursed

What are the eligibility criteria for accessing benefits from the Shrama Samarthya Toolkit scheme?

1. The beneficiary should be within fifty-five years of age

2. The beneficiary shall complete skill acquisition or skill upgradation training in masonry, plumbing, carpentry, bar bending & scaffolding, painting, tile laying, electrician, welding & steel fabricating, etc., acquired from skill development centers established by the board jointly with other Government departments in this regard. Tool kits will be provided after completion of the training.

3. The training programs shall include skills required for the construction workers to improve their awareness & employability the board shall bear the expenditure for the wage compensation of the trainees, boarding & lodging, Trainer & Master Trainee.

4. This facility shall be available to a beneficiary only once during his membership in the board.

5. While claiming this assistance the beneficiary shall produce the original certificate for having undergone skill acquisition or skill upgradation training along with the application in Form XV

**[Click here to apply for Shrama Samarthya Toolkit](https://kbocwwb.karnataka.gov.in/login)**

What type of documents are required for the application?

1. Application in Form XV

2. Photocopy of ID card attested by gazetted officer

3. Proof of Bank Account

4. This training facility can be availed once during membership of the beneficiary

5. subscription certificate by SLI/LI

6. Application processing and Verification (if required) by Labour Inspector

7. Review and Approval by the Board

8. Issue of training certificate by training center

Common reasons why construction workers fail to receive the benefits under Shrama Samarthya Toolkit

Exclusion owing to eligibility conditions

1. Labor has to be registered as a construction worker

2. Labor must be within 55 years of age

3. Labor has undergone and completed training in various skills like masonry, plumbing, carpentry, and more at government-established skill development centers

Exclusion owing to scheme related

1. Unskilled workers and helpers are not eligible for toolkits

Exclusion owing to on-ground implementation

1. Some individuals who work as masons might label themselves as just 'helpers'. Masons receive kits while helpers don't.

2. This benefit is seasonal and involves the department contacting organizations, informing them about the provision of mason kits, painter kits, etc. Organizations are then instructed to organize their documents accordingly. This initiative has been in place for the past 2-3 years, specifically in 2021 for masons, 2022 for painters, and the details for the year 2023 are yet to be declared.

What are the eligibility criteria for accessing benefits from free BMTC bus pass?

A registered construction worker who is a permanent resident of Bengaluru City (Bruhat Bengaluru Mahanagara Palike Limits) is eligible to avail the benefit of BMTC Bus pass.

What type of documents required for application?

1. Labor card of the registered beneficiary

2. Aadhaar Card

3. Two stamp size Photo

Common reasons why construction workers fail to receive the benefits under Education assistance

Exclusion owing to eligibility conditions

1. To avail themselves of the benefits, laborers must register as construction workers, but this requirement applies mainly to trades like masonry, plumbing, and electrical work, rather than to roles such as gardening and parking area maintenance, which are not categorized as part of the construction workforce.

2. Worker need to be permanent resident of Bangalore City.

Exclusion owing to documents related

A registered construction worker who is a permanent resident of Bengaluru City (Bruhat Bengaluru Mahanagara Palike Limits) or the place from where he travels to Bengaluru is eligible to avail the benefit of BMTC Bus pass. Local address not required as long as registered in Bangalore.

Exclusion owing to scheme related

1. The scheme has exclusively extended benefits to laborers with permanent residency, leaving out all other workers without such residency status.